interest tax shield meaning

Interest Tax Shield A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income. An interest tax shield refers to the tax savings made by a company as a direct result of its debt interest payments.

Chapter 15 Debt And Taxes Ppt Download

This is called a tax shield which is an allowable deduction from taxable income that saves you money on the tax bill.

. Interest that a company pays on a loan or debt it carries on its balance sheet is tax-deductible. The payment of interest expense reduces the taxable income and. The reduction of ones taxable income as the result of a properly qualified deduction.

We also call this Interest tax shield. This reduces the amount of income that is. Interest Tax Shield As the name suggests and discussed earlier the interest tax shield approach refers to the deduction claimed in the tax burden due to the interest expenses.

The interest tax shield is positive when the Earnings Before Interest and Taxes EBIT is greater than the interest payment. As is hopefully clear by this stage the interest tax shield is. A tax shield is a certain effect that occurs when.

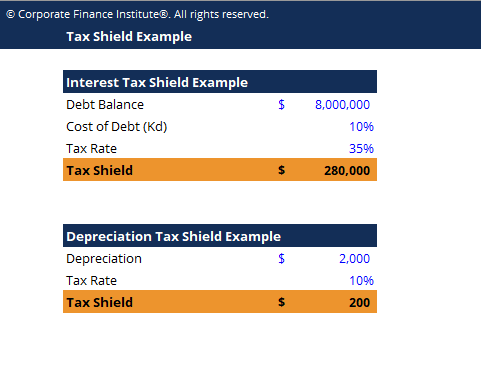

Tax Shield Deduction x Tax Rate To learn more launch our free accounting and finance courses. Interest tax shields refer to the reduction in the tax liability due to the interest expenses. For example a mortgage provides an interest tax shield for a.

It means using tax-deductible interest for lowering the total tax liability. Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above formula. The tax savings for the company is the amount.

Find banking definition of Interest tax shield with DhanGuard banking dictionary. Interest tax shield refers to savings on taxes by reducing taxable income with interest expenses. Finance Meaning Read related entries on Financial Terminology I Finance Terms IN.

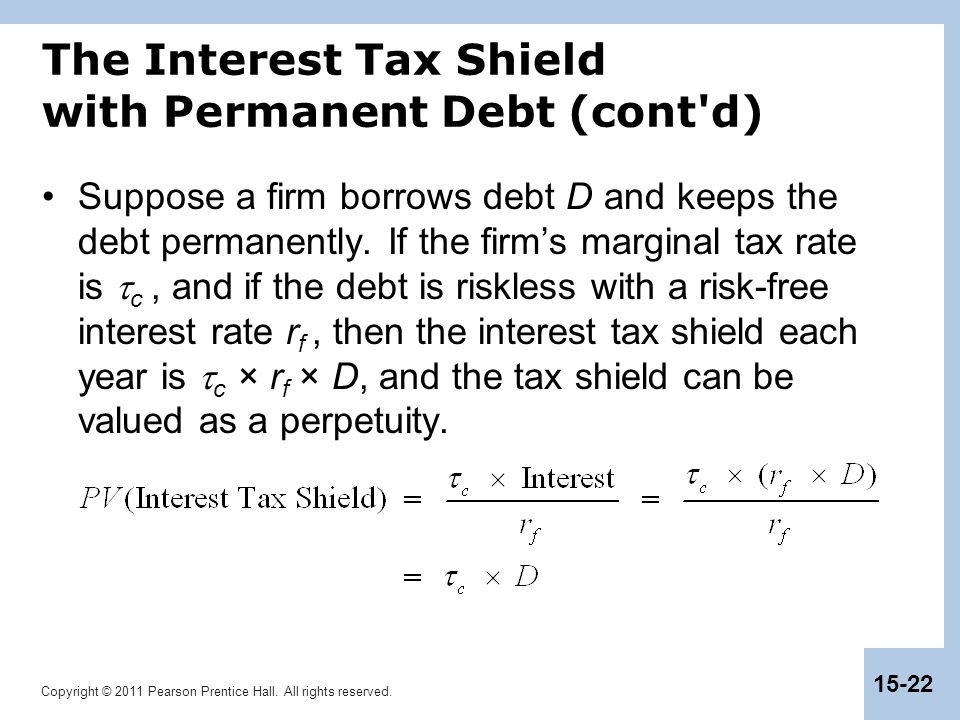

It is also notable that the interest tax shield value. Such allowable deductions include mortgage. Interest Tax Shield A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income.

Interest expenses via loans and. For example a mortgage provides an interest tax shield for a. Suppose the Taxable Income is 1000 and deductible expense amount to 300 with a.

The Interest Tax Shield refers to the tax savings resulting from the tax-deductibility of the interest expense on debt borrowings. Financial Definition of Interest Tax Shield. A tax shield refers to an allowable deduction on taxable income which leads to a reduction in taxes owed to the government.

DhanGuard banking dictionary is an easy to understand guide to the language of law with banking words. Interest Tax Shield Example A company carries a debt balance of 8000000. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest medical expenditure charitable donation.

Interest tax shields are a method of reducing taxable income by deducting the interest payments on debt from taxable income. Examples of tax shields include mortgage interest deductions charitable donations and. Companies pay taxes on the income they generate.

Interest Tax Shield Author.

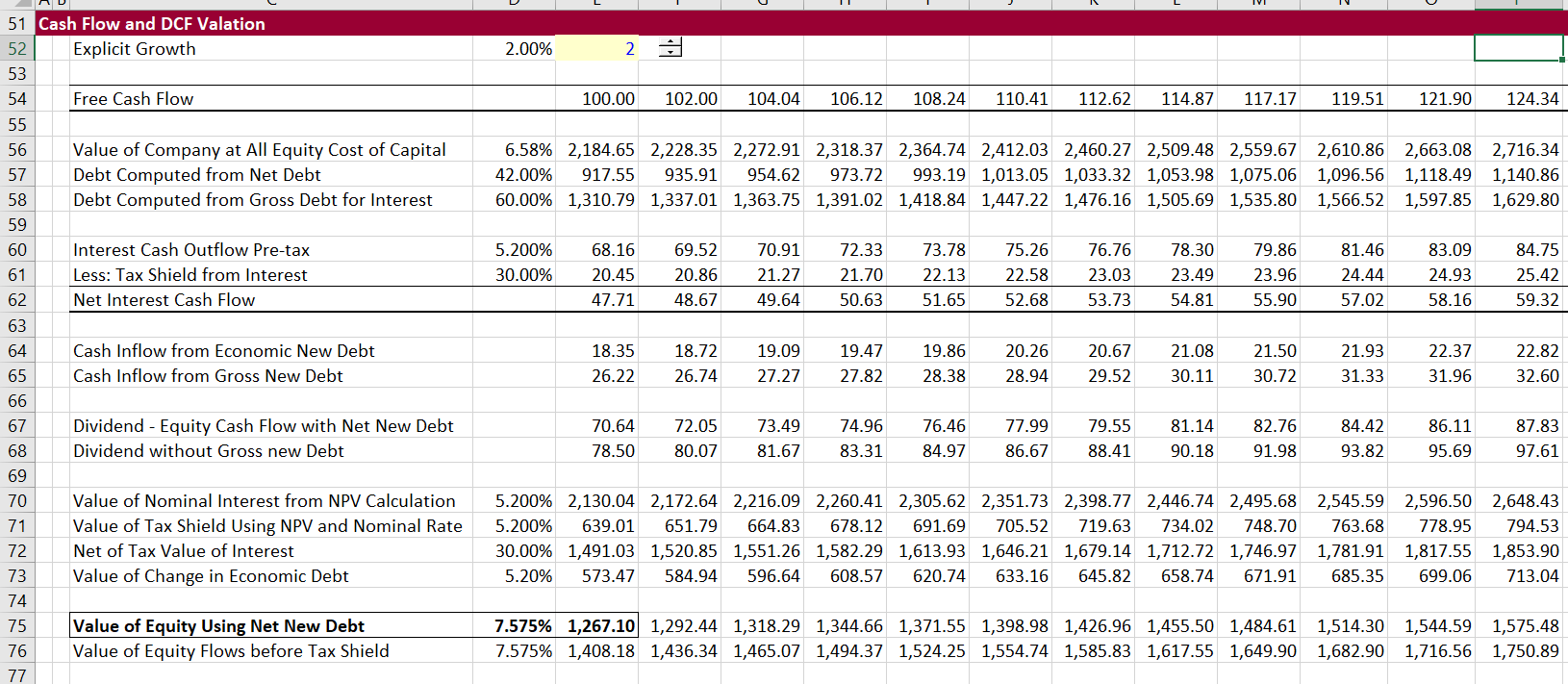

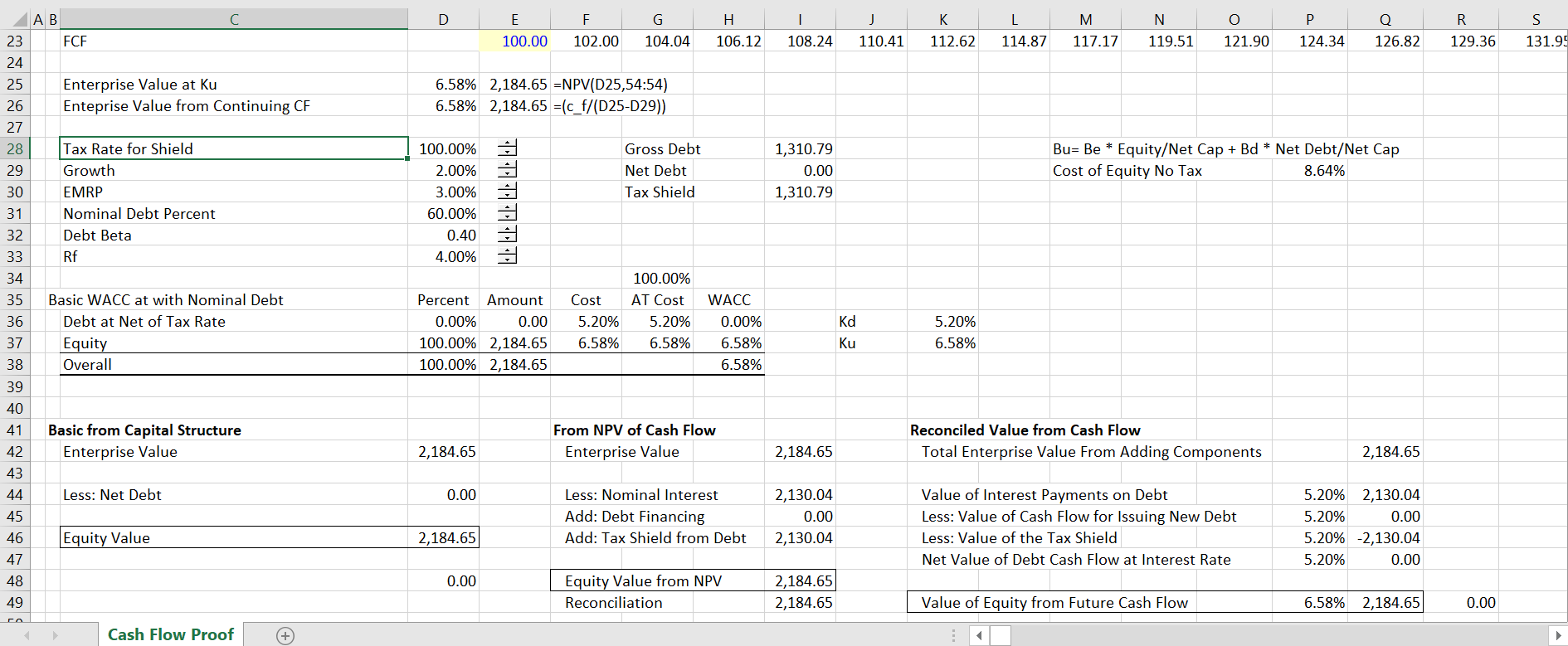

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Purifying Islamic Equities The Interest Tax Shield Rozenberg Quarterly

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

Depreciation Tax Shield Formula And Calculator

Tax Shield Example Template Download Free Excel Template

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

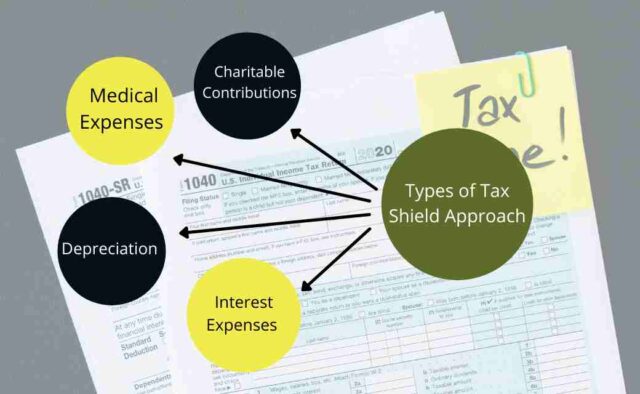

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

Tax Shield Meaning Importance Calculation And More

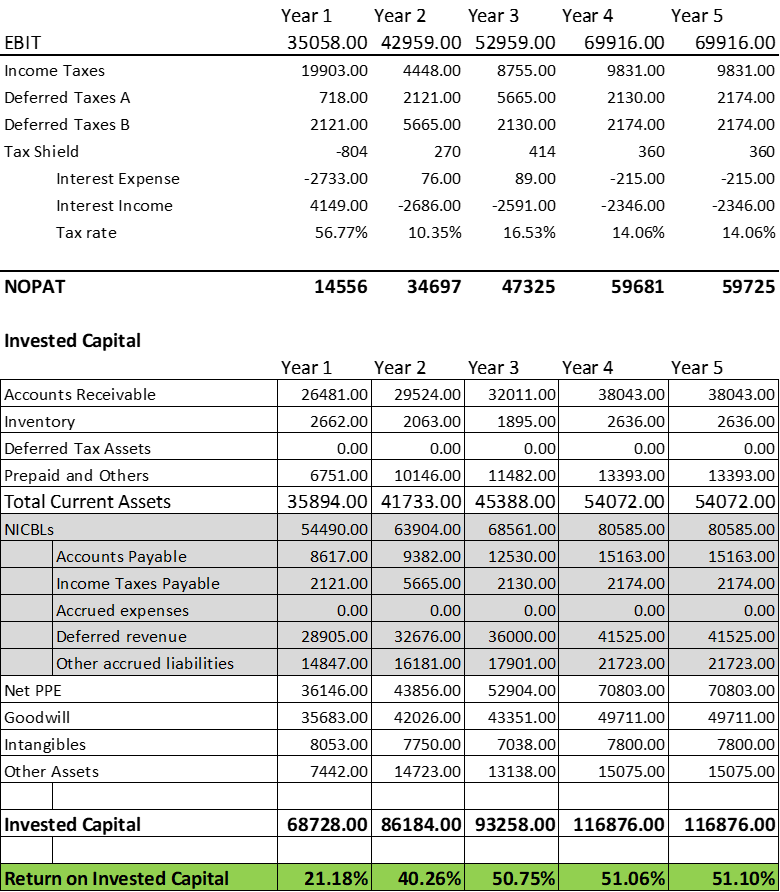

Assessing The Capital Allocation Skills Of Management

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

What Is A Tax Shield Depreciation Tax Shield Youtube

What Is A Tax Shield Definition From Divestopedia

What Are The Value Drivers Of A Leveraged Buyout Toptal

Interest Tax Shields Meaning Importance And More

Interest Tax Shields Use Interest Expense To Lower Taxes

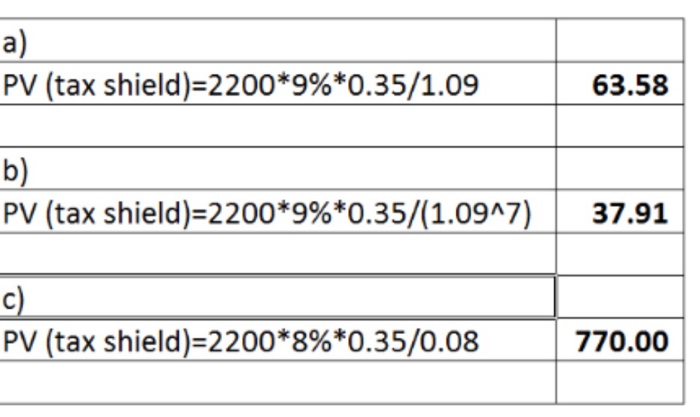

Solved Compute The Present Value Of Interest Tax Shields Chegg Com